Why Buy Executive Condominium?

Thank you for your interest in know more about Executive Condominium (EC). You may be one of the many HDB upgraders that wish to know how to go about about improving your lifestyle and making money while doing it. You have came to this page because you want to know if you can buy a EC in Singapore?

I will show you why?

- Why EC?

- Eligibility.

- Financing.

- Typical Example.

- Profit.

Why Executive Condominium?

EC is introduced to provide alternative housing for the sandwich class. These is the segment of the population who are not qualified to buy BTO and Private housing is too expensive for them.

Now that there are no more EA and EM being build not. For Upgraders, the only alternative is EC. EC is developed by private developers but can sell only to eligible families. After 5 years of MOP, EC can be sold as private property but to Singaporeans only. After 10 years, it can be sold to foreigners after 10 years.

Another factor why most upgraders buy EC is because when the sell the EC after 5 years or more, they sells at almost the same price of Private Condominium of the same age and location.

Eligibility

Financing

EC has 2 payment scheme. Normal Progressive Payment and Deferred Payment Scheme. Buyers can make use of the value of their present HDB flat to secure a bridging loan. This will help on the cash follow of the payment. Please read more here.

Typical Example

Please note that the first 5% which is the booking fee is cash only. The second 15% can be paid using CPF (Central Provident Fund) or Cash. This depends on the amount of loan and CPF you have in the Ordinary Account. For the rest, 5% will be in cash/CPF and the rest of the 75% can be paid in cash, CPF or by the loan. The loan must be from Financial Institutes (banks).

No HDB loans for Executive Condominium purchases.

This may seem complicated. Yes, it is!! Call me now to have your financing computed and later verified by a banker.

If you own a flat now, you may use your CPF invested in your present flat to secure a bridging loan. This is complicated and many buyers miss out owning an Executive Condominium because they are unaware of this. Call now 93381648 to have this calculated for you.

Payment Schemes

There are 2 payment scheme applicable to payment of your EC. These are Normal Payment Scheme (NPS) and Deferred Payment Scheme (DPS). Payment in the NPS is progressive as the progress of the construction and with the DPS, after the first 20%, the next payment of 65% will be mead before the TOP (issuance of the Temporary Occupation Permit).

Comparing the 2 schemes for upgraders, using DPS and bridging loan makes buying an EC very viable. Looks complicated. Please call Chay at 9338 1648 for more information.

Profit

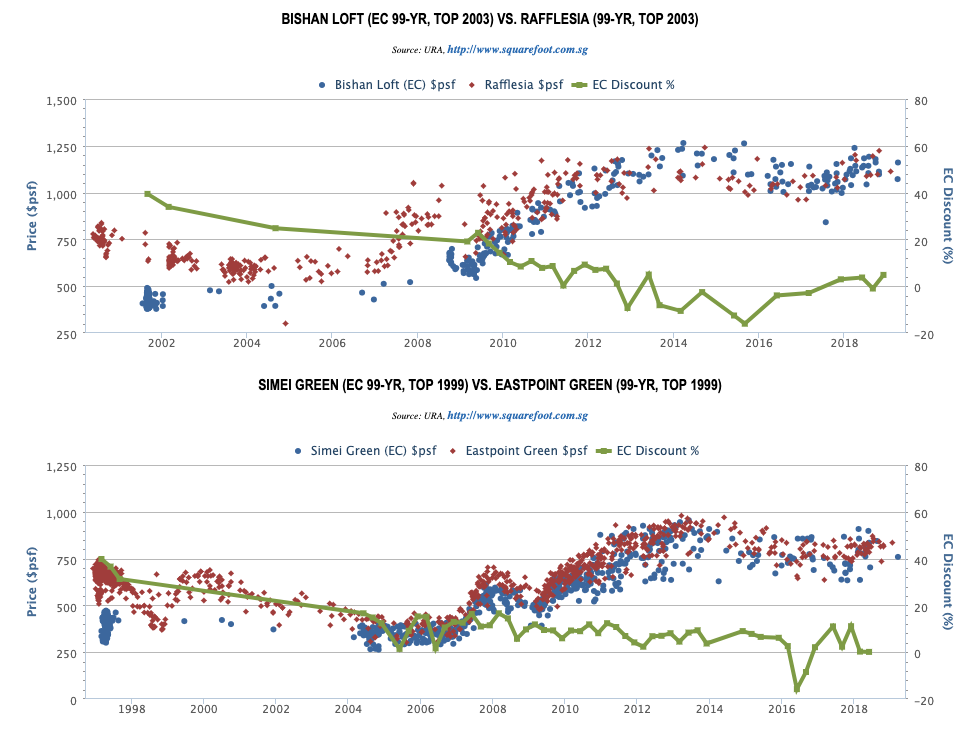

Many EC, which have completed the MOP, are now selling at prices of private property of the same location and age.

As shown above, the prices of EC after MOP and Private Condominium, are selling off at the same $psf. Both this example are of similar age, location and even distance from MRT. The gain in pricing can be as high as $200psf to $300psf. www.squarefoot.com.sg

Conclusion

HDB Upgraders can look forward to improving their lifestyle, upgraded to be a private property owner after 5 years of MOP (Minimum Occupation Period), enjoy the facilities and amenities, as well as make a profit when they buy an Executive condominium.

Call Chay at 9338 1648 now to find out more details. Visit Official.com.sg for more information.

For more information on upcoming EC sites, Visit HDB Executive Condominium website.

For Executive Condominium Eligibility, visit HDB Executive Condominium Eligibility website.